7 simple techniques for the instant insurance guide delaware department of

New Hampshire and Virginia are the only 2 states that do not call for car insurance coverage. That stated, there is nobody country-wide regulation when it pertains to how much auto insurance you need to have. Each state has a various minimum amount of car insurance coverage that vehicle drivers need to acquire in order to legally drive on public roads.

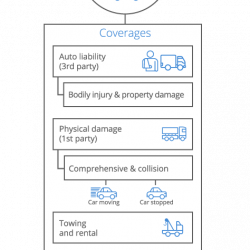

Some states only call for, which covers bodily injury (BI) and residential or commercial property damage (PD) you do to another person. Various other states might call for additional clinical coverage or what's often recognized as, which covers healthcare expenses you or your travelers sustain. And also some states may call for, however after that in various other states this sort of insurance coverage can be optional.

Things about Liability Insurance For Drivers: How Much Do You Need?

If you're confused, there's good information: You really just need to stress over the needs where you live, so you can jump to your residence state and make certain your coverage fits the compulsory minimums. You need to meet the minimum quantity of car insurance required in your state, Liability protection, the foundation of every vehicle insurance plan, is required in virtually every state, Comprehensive and also accident protection are not mandated in any kind of state, however given that they https://6080b59897b94.site123.me/#section-60a43d40e6b38 pay to fix damages to your cars and truck, we highly suggest adding them to your policy, Some states need injury protection (PIP) which covers costs you or your travelers incur if you're hurt in an accident, What types of auto insurance policy protection are needed? Vehicle insurance policy requirements vary, yet almost all states call for motorists to have some quantity of obligation insurance coverage.

Below we broke down the basic elements of what's normally referred to as a " complete insurance coverage" vehicle insurance policy plan: Physical injury obligation, The component of your obligation insurance coverage that pays for medical costs if you have actually injured somebody in a mishap, Building damages responsibility, The various other component of responsibility protection, covers the price of home damage you have actually created in a crash, Accident security, Covers medical expenditures for you or your passengers after a crash, Uninsured/underinsured motorist, Covers the expenses if you remain in an accident brought on by a driver with little or no auto insurance, Comprehensive, Covers damage to your cars and truck that takes place when you're not driving, Accident, Covers damages to your auto after a vehicle crash, regardless of that was at fault, Like we stated above, comprehensive as well as accident insurance coverage are, yet this kind of coverage supplies beneficial protection for your automobile, which isn't covered by your liability protection.

Little Known Facts About Mandatory Liability Insurance Manual Table Of Contents.

Michigan additionally calls for residential property security insurance policy (PPI), with a minimal restriction of $1 million in property damages insurance coverage. PPI can cover problems despite who caused the crash, as Michigan is a no mistake state. $30,000 $60,000 $10,000 $20,000 per mishap; $20,000 for loss of income per accident $25,000 each; $50,000 per mishap $25,000 $50,000 $25,000 Optional Optional $25,000 $50,000 $10,000 Optional $25,000 each; $50,000 per occurrence $25,000 $50,000 $10,000 Optional Optional Insurers need to provide uninsured/underinsured motorist protection yet it can be decreased by the motorist in writing.

Motorists are still liable for paying for physical injury as well as residential property problems if they create a vehicle crash. And also, if you do choose to purchase car insurance policy in New Hampshire, you must meet the minimums over.

The Main Principles Of Insurance Requirements For Contractors – Finance + …

But there's also a state optimum of 100/300/50. $25,000 $50,000 $10,000 Optional $25,000 per individual; $50,000 per accident $25,000 $50,000 $20,000 Optional Optional, The just two states that don't require cars and truck insurance are New Hampshire and also Virginia. Motorists in Virginia can pay the state $500 a year in lieu of car insurance policy, but that cost does not provide protection in the event of an accident.

Automobile insurance policy minimums are indicated to be a beginning factor for insurance coverage, however they might not cover the full cost of an accident, and also the minimums alone may not pay for damages to your automobile. Every state that requires auto insurance policy protection includes obligation, and also some need you to have accident defense or uninsured/underinsured vehicle driver insurance coverage, yet none require extensive as well as collision protection.

Little Known Questions About Auto Insurance – Kansas Insurance Department.

Collision protection pays for damages to your automobile after an accident, no matter that caused it, and also thorough insurance coverage covers the sort of damages that can take place to your car when you're not driving it. That suggests if a tree branch drops as well as dents your hood or you back right into a tree as well as smash your back bumper and you don't have compensation as well as accident insurance coverage, you'll need to pay the costs to repair your automobile on your own.

Ingen kommentarer endnu