what is collision insurance bluefire insurance things to know before you get this

Uninsured as well as Underinsured Driver Coverage These separate but similar protections assist you out in case you're struck by a driver that has no insurance, or some yet not enough to cover the cost of the problems. Also, if you're in a hit and also run, these protections have your back.

Talk with your American Family members Insurance agent to discover exactly how you can customize your auto insurance protection to maintain you driving risk-free, happy as well as protected. * Have to have no major website traffic violations in the home to be qualified.

According to the most current data from the NJ Division of Transport, Garden State vehicle drivers were associated with a massive 278,413 crashes in 2018. Bergen Area alone saw a total amount of 29,459 of those accidents. If you have actually been a New Jersey chauffeur for any size of time, you recognize that the state's highways can be dangerous areas.

It can be argued that New Jacket accident insurance coverage is an essential factor to consider in the Garden State because the stakes are a little bit greater. What is Crash Insurance coverage for? Accident insurance coverage in NJ can assist you cover physical damages that your vehicle endures in mishaps from rollover accidents to parking area fender-benders to hitting stationary items like trees or mailboxes.

The Only Guide for Collision Insurance Coverage – Usaa

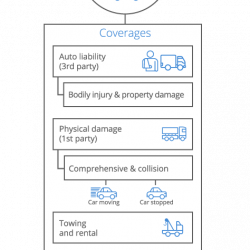

Find out more about what it covers, how it may be practical, and also just how it fits into your overall automobile insurance policy protection plan. What Does It Cover? Many covered circumstances in which your cars and truck is damaged by a collision with a fixed object or an additional auto will be handled by the collision portion of your vehicle insurance policy.

However, you will typically need to include it to your policy if you funded the purchase of your vehicle or you lease your automobile. If you have a loan for your automobile and also are currently paying it off, your lending institution still technically has the vehicle and also may require that you carry collision coverage.

You can conserve money by obtaining an accident quote and also purchasing it on your very own. If you're not required to acquire the coverage, the choice to purchase it will be various for every person.

If you drive an older car that would certainly not set you back much to replace, you might have factor to forego acquiring accident insurance coverage. If your vehicle still has a high worth as well as an extra pricey replacement or fixing cost, you will wish to look a lot more carefully at adding accident protection to your plan.

10 Simple Techniques For What Is Comprehensive Vs. Collision Coverage – Allstate

Accident coverage or collision insurance policy helps spend for damage to your lorry if you are in an accident with an additional car or object, or if your lorry surrender. What Is Crash Insurance coverage? Accident coverage helps cover the prices to repair or replace your car when it is associated with an accident with an additional automobile or item.

What Is the Distinction Between Crash as well as Comprehensive Coverage?.

What is crash coverage? Crash protection assists pay for the expense of fixings to your car if it's struck by another lorry. It may likewise aid with the price of repair work if you struck one more vehicle or object. That indicates you can utilize it whether you're at mistake or otherwise.

That indicates it would not pay for damage to an additional individual's lorry or residential property. Crash likewise doesn't cover all damage to your lorry. Instances of damages not covered are: Theft Criminal Damage Floods Fire Striking an animal If you want to know more concerning protection for these sort of problems, have a look at the detailed protection web page.

Some Known Incorrect Statements About When To Drop Collision Insurance? – Car Insurance Guru

What is a crash insurance deductible? An accident insurance deductible is the amount you have actually concurred to pay prior to the insurance coverage firm starts paying for problems.

Let's claim you're associated with a crash that creates $1,000 in damage to your car and you have a $250 insurance deductible on your accident protection. You'll pay the very first $250 in damages, usually to the body store, as well as after that your insurance coverage will pay the staying $750. The above is meant as general info and as basic plan descriptions to aid you comprehend the various kinds of protections.

Ingen kommentarer endnu