7 simple techniques for how life insurance premiums are calculated gocompare

When acquiring insurance coverage it is essential to look around to get the best plan for you, particularly if your own situations have altered throughout the years. It is also worth thinking about whether there have actually been any adjustments in your situations which could allow your present insurance provider fee you a reduced premium.

When your insurer determines your premium, it is likely to take a variety of elements into account. Some essential aspects influencing your costs might include: Type of cover selected Any type of optional advantages you have picked under your plan Discounts you are qualified for Previous insurance claims and also incident history Whether you select to pay your costs yearly, monthly or by instalments Government tax obligations and any kind of state or area obligations or levies Exactly how much cover you want Your danger assessment by the insurance firm The degree of excess you choose Stabilizing premium rates Functioning out the correct cost for insurance coverage premiums is an intricate procedure that should balance the accessibility of funds, the chance of specific claims (the threat) and also the capability for the swimming pool of money from all insurance policy premiums to cover the expense of cases.

Some insurance firms bill a little service charge; others bill a slightly higher costs. Under a regular monthly instalment plan, if a claim is lodged at any moment throughout the plan duration the remainder of the annual costs will certainly still require to be paid. Not all risk coincides No one can be sure what losses they may experience not everyone's danger will coincide.

The Facts About How Are Insurance Premiums Calculated? – Policybee Uncovered

Due to this, insurance costs will certainly differ from individual to person since insurance firms try to make sure that each insurance policy holder pays a premium that shows their very own specific level of risk. No 2 insurance firms use the exact same policy with the exact same terms, as well as this can make comparing policies extremely essential.

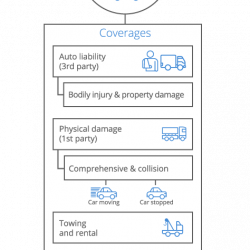

Likewise crucial to note, auto insurance policy premiums are separate from your deductible, which is the buck amount you have to pay prior to your insurance policy will certainly kick in. All kinds of insurance need you to pay a costs, not just vehicle: home owners, life as well as occupants insurance coverage likewise call for premium payments. How are Automobile Insurance Costs Determined? Insurance policy business take into consideration lots of aspects when establishing cars and truck insurance policy costs.

For instance, a 16-year-old boy in a brand-new cars will pay a lot greater insurance coverage premiums than a 40-year-old woman in a terminal wagon. This is due to the fact that the child is much more likely to be in an accident, as well as his car will be much more pricey to fix if he obtains in one.

How An Insurance Company Determines Your Premiums Fundamentals Explained

Here are some details your insurance company may think about when setting your premium.: Your age, gender and where you live.: The more accountable you have been in the past with your cash and also behind the wheel, the reduced your premium.: Newer, faster and a lot more pricey vehicles have higher costs throughout the board.

It's not sensible to relocate to a different city or transform your age just to save money on automobile insurance policy. Yet you can usually customize your http://listofcarinsurancecompaniesubng054.iamarrows.com/little-known-facts-about-premium-calculator-for-cargo-insurance-costs-roanoke-trade insurance plan to fit your requirements and also your spending plan, as long as you stay within the insurance policy requirements in your state. Something to remember when personalizing your protection: Several insurer will show you a break down of your protection, so you can make an informed choice concerning what will certainly lower your premium while thoughtfully balancing danger.

: The Distinction Between a Quote as well as a Premium When you get an insurance policy quote from an insurance coverage firm, that's a quote of just how much the business will certainly bill you for insurance policy. In order to balance precision with simplicity, insurance policy firms do not gather as much info when developing an insurance policy quote as they do when writing a real plan.

A Biased View of Insurance Calculators – Nerdwallet

When you've really enrolled in insurance, your insurance provider could determine your while determining your costs. Your price could be much better or worse than what was defined for your quote.: How Commonly Do I Need To Pay My Costs? Various insurer will certainly ask you to pay your car insurance costs at different periods.

Numerous insurer will allow you choose exactly how commonly you would love to payand you'll generally obtain a "paid in complete" discount when you pay pay more upfront.: Nevertheless, in many cases, you might be needed to pay your entire term upfront. This is especially common if you're considered an at-risk driverfor instance, if you formerly allow your insurance coverage lapse or you require an.

Ingen kommentarer endnu